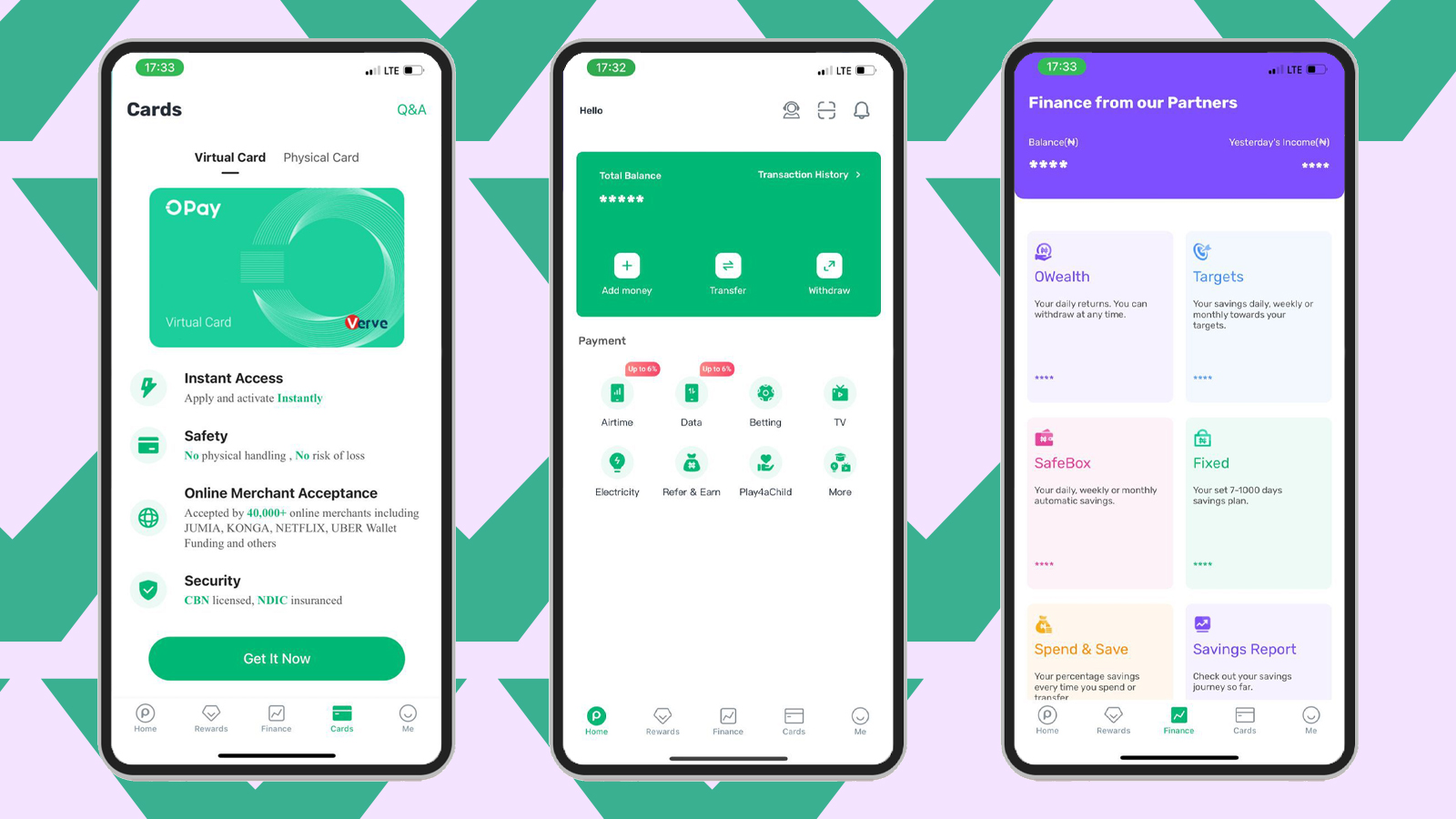

Popular fintech company Opay has announced a new policy affecting electronic transfers into personal and business accounts. Starting Monday, September 9, 2024, customers will be charged a one-time fee of ₦50 for any electronic transfer exceeding ₦10,000. This fee, known as the Electronic Money Transfer Levy (EMTL), is mandated by the Federal Inland Revenue Service (FIRS) and is part of the company’s compliance with government regulations.

In a message sent out to customers on Saturday, Opay clarified that the new charge is not a company-imposed fee but a government-mandated levy. The company emphasized that it does not profit from this charge, as the entire amount is directed to the federal government in accordance with FIRS regulations.

The message from Opay reads: “Dear valued customer, please be informed that starting September 9th, 2024, a one-time fee of ₦50 will be applied to electronic transfers of ₦10,000 and above paid into your personal or business account in compliance with the Federal Inland Revenue Service (FIRS) regulations. It is important to note that Opay does not benefit from this charge in any way as it is directed entirely to the federal government. Thank you for your understanding.”

In addition to this new levy, Opay has once again reaffirmed its strict prohibition on cryptocurrency and virtual asset trading on its platforms. The company has taken a firm stance against any form of cryptocurrency transactions, reinforcing its commitment to maintaining the safety, integrity, and regulatory compliance of its financial services.

Gotring Wuritka Dauda, the Chief Executive Officer of Opay Nigeria, reiterated this policy in a recent statement, emphasizing that the company does not support or permit cryptocurrency trading on its platform. He assured customers that Opay is dedicated to upholding legal and regulatory obligations, and as part of these efforts, the company conducts daily scans of its platform to identify and prevent any unauthorized cryptocurrency or virtual currency activities.

Dauda further stressed that any account or wallet found to be engaging in cryptocurrency or virtual asset trading will be immediately closed, and the details will be reported to the appropriate regulatory authorities. This strict enforcement underscores Opay’s commitment to adhering to financial regulations and ensuring the security of its platform for all users.

Opay’s actions reflect its dedication to providing a compliant and secure financial service, while also ensuring that its users are informed and protected in an evolving regulatory landscape.